We need to talk about boring businesses.

Buying “boring” businesses has been a very popular trend for the last few years, primarily driven by social media influencers like Codie Sanchez.

The idea is that you can create passive income by purchasing simple, under-the-radar businesses like vending machines, ATMs, car washes, parking lots, and laundromats. Simply install an operator, and voila—mailbox money!

Seems easy enough. After all, how hard could it be to run a laundromat?

But… is it real? Are there really riches in boring niches?

First, a little history of the boring business movement.

While acquisition entrepreneurship isn’t exactly new, we can perhaps partially trace its recent rise in popularity to my good friend Walker Deibel’s bestselling book, Buy Then Build, which was released in 2018.

Buy Then Build is an excellent book. Walker expertly lays out the case for why acquiring an existing, cash-flowing business is a better bet than trying to start one. Bottom line: startups are risky. The vast majority fail in the first couple of years. Central to the thesis is the idea that the longer a business survives beyond the first year, the more likely it is to continue surviving. Beyond year five, well, the odds are ever in your favor.

Further, there is evidence that a massive wave of retiring baby boomers with service businesses have no succession plan because their children all want to work at Google or be YouTube influencers.

If one were to acquire one of these businesses, it makes sense that there would be many opportunities to modernize via technology. For example, marketing budgets could be shifted from billboards to Facebook ads and Google search. Everything from sales to project management could be improved with technology, increasing productivity and profitability and ultimately fueling growth and breathing life into a decades-old business.

But how does all this translate to ice machines and mailbox money?

Quite simply, it doesn’t.

Buy Then Build and Walker’s immersive training program for budding acquisition entrepreneurs, the Acquisition Lab, both stress the importance of hands-on management and learning the business fundamentals, especially during the critical first year.

Business acquisition is nuanced. Proper due diligence is a critical skill. And most importantly, it’s hard work.

The new owner needs to be ready to roll up their sleeves, but also must approach their new endeavor with a healthy dose of humility. While they may have an advantage in understanding technology, to assume that the previous owners didn’t know what they are doing just because they use fax machines is to almost guarantee failure.

And herein lies the rub. Walker painstakingly conveys all of this information in Buy Then Build, but it’s a 300-page book.

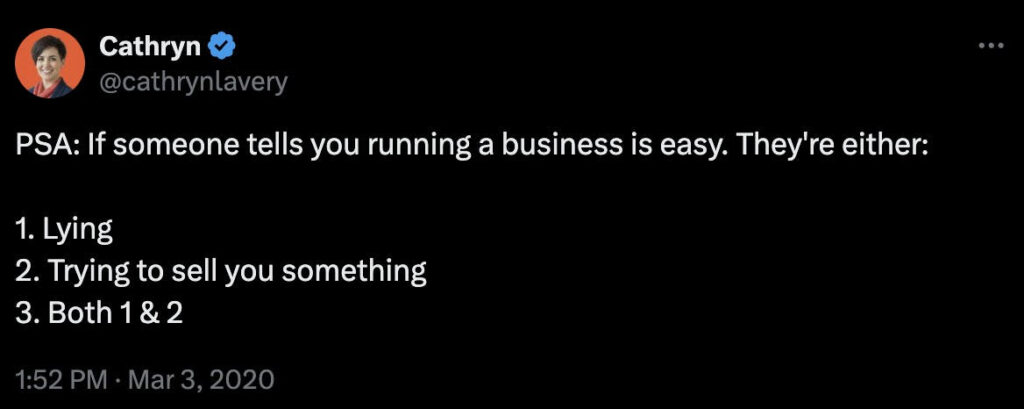

Social media, on the other hand, has no room for nuance.

A 60-second short form Instagram clip is designed for one purpose: to garner eyeballs.

And so they sell the dream.

Now, I’ll take a quick beat here to say that I have massive respect for Codie and the movement that she has (partially) inspired. I think her content is world-class, and while I don’t have first-hand experience with her programs, I know that they have helped many acquire businesses, and I count that as a win.

The problem really comes with the idea that you can acquire one of these boring businesses, hire someone to operate it, and collect passive income.

Let me be clear: there is nothing passive about it.

For most of these small businesses (think ice machines or laundromats), the math of hiring an operator to run it while you collect the profits just doesn’t pencil.

But rather than just telling you, let’s walk through a simulated laundromat acquisition case study.

Here’s a breakdown based on typical industry standards and national averages, assuming the laundromat is in a decent location in a medium-sized city.

Acquisition:

Typical Purchase Price: The price of laundromats can vary based on location, equipment condition, and profitability. For this case study, we will assume the purchase price is $250,000. This is an average price for a laundromat generating moderate revenue in a medium-sized city.

Down Payment: With a 20% down payment, the initial cash investment would be $50,000.

Financing: The remaining $200,000 is financed via a Small Business Administration (SBA) loan at an average interest rate of 7% over a 10-year term. This gives an estimated monthly payment of $2,322.

Average Monthly Revenue: Based on typical industry numbers, a laundromat in a decent location can generate around $15,000 in revenue per month.

Annual Revenue: $15,000 x12 = $180,000 per year.

Operating Costs:

Rent: For a medium-sized city, rent for commercial space can range from $2,000 to $4,000 per month. Let’s assume $3,000/month, or $36,000/year.

Utilities: Water, electricity, gas, and other utilities are significant expenses. A laundromat typically spends around $1,500/month, or $18,000/year, on utilities.

Maintenance and Repairs: With regular equipment upkeep, expect $500/month, or $6,000/year.

Supplies (Detergent, etc.): Estimate around $300/month, or $3,600/year.

Insurance: Typically, $1,200 to $2,000/year for business insurance. Let’s assume $1,500/year.

Other Miscellaneous Costs: Advertising, licenses, etc., can add another $200/month, or $2,400/year.

If you decide to hire an employee to manage day-to-day operations:

Labor: A typical laundromat attendant earns around $12-$15/hour. Let’s assume $14/hour for a 40-hour week, which gives us an annual wage of $29,120.

Payroll Taxes and Benefits: Estimate an additional 10% of wages, or around $2,912, bringing the total labor cost to $32,032/year.

Total Operating Expenses (Including Labor): $99,532/year

Profit:

Gross profit is calculated as revenue minus total operating expenses:

Gross Profit: $180,000 – $99,532 = $80,468/year

Net Profit: $80,468 – $27,864 Annual loan repayment (SBA loan) = $52,604/year

Return on Investment (ROI): $50,000 (down payment) / Net Profit: $52,604/year

Cash on Cash ROI in Year 1: 105.2%

A 105% year-one ROI is certainly nothing to turn your nose up at.

But let’s consider the hidden costs – namely, your time.

Anyone who has ever had a $14/hr employee knows that those types of employees do not operate autonomously. They require close management and supervision.

Let’s just assume you can get away with 5 hours a week of onsite management. I’d add a few more in there for administrative tasks like managing cash flow, ordering supplies, taxes, etc. Let’s call it 8 hours a week.

Now, no one reading this newsletter is going to happily live on $50k a year, so let’s assume you acquire four more laundromats and are well on your way to building your empire.

Congratulations! You are now working 40 hours a week and making $250,000.

You have bought yourself a job.

If you want to buy back your time and hire an operator to run your laundromats and manage the employees, you are going to have to pay for someone who is competent enough to manage 5 locations and has the operational experience to handle the various complexities of running a multi-location business. That person will cost a minimum of $150k, but perhaps closer to $200k+ if you also want to delegate complexities like finances. And, by the way, that person still requires oversight and management.

I would also be remiss in ignoring the time invested in learning what it takes to operate a laundromat smoothly. Even if you hire an operator, you have to have enough specific knowledge to know whether they are doing a good job and hold them accountable.

Lastly, laundromats have a natural ceiling on profitability. Even if you choose to upgrade to the latest equipment and technology, each location can only handle a certain amount of volume. In order to continue growing the business, you have to continue acquiring locations.

Now, if your goal is to own a chain of laundromats, I hope this doesn’t crush your dreams. This is a fine pursuit and could create a wonderful lifestyle business.

But here’s the bottom line when it comes to boring business acquisition:

The person doing the work is the person that makes the money.

For most founders who already have a business, a laundromat side hustle will be nothing more than a massive distraction from what actually matters – their primary business.

So before you run off and chase the dream of passive income, remember:

There is no such thing as a free lunch.

To keeping the main thing the main thing,

Mb