“When the tide goes out, that’s when we see who has been swimming naked.” – Warren Buffett

I love a good quote from the Oracle of Omaha, but this one has to be one of my favorites.

Despite doing my best to avoid the toxic 24-hour news cycle, I woke up Monday morning to a flurry of headlines about a dramatic stock market selloff. The Dow tumbled 1,000 points, while the S&P 500 lost 3% for its worst day since 2022.

But by the end of the week, things were back to normal, with Monday’s losses being almost fully erased.

This has been the trend for the last handful of years. Even a global pandemic only resulted in a quick V-shaped correction, and the market has been roaring ever since.

Is this type of bull market sustainable?

History would say no.

I don’t know how, and I certainly can’t predict when, but at some point, the proverbial tide will go out.

The real question is not if or even when the next downturn will hit.

The question that we all must answer is how can we ensure that we are wearing pants?

Market corrections and recessions are especially bad for two groups: people in their retirement years who must sell stocks to cover their living expenses and people who are over-leveraged.

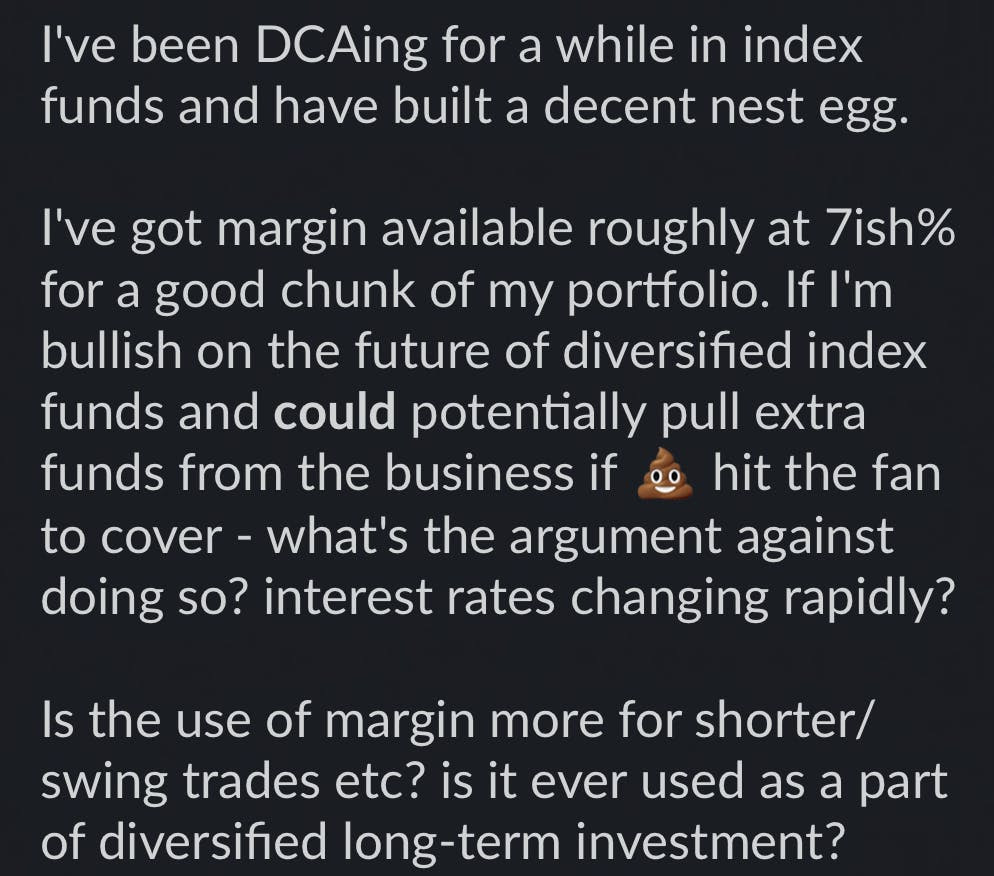

Just last week, a younger gentleman asked this question in a Slack group where I’m a member:

These types of questions get asked when a bull market is getting long in the tooth.

When it seems like stocks can only go up, it’s only natural to start to believe that we can’t lose.

There was a time when I, too, thought I couldn’t lose.

The year was 2014. The oil & gas industry was booming, and my firm was booming with it.

I took $400,000 and funded my trading account.

2008 was a distant memory; besides, I didn’t have any real money invested during those days to feel it since I was busy across the world fighting a war.

For the couple of years prior, I had worked at an investment firm that not only bought and sold oil and gas properties but also had a trading desk.

They were engaged in sophisticated trades to hedge their exposure, and I spent all of my free time watching and learning about what they were doing.

I was enthralled. I loved the idea of making money with only my mind and a laptop, and I jumped in headfirst.

In six short months, I had turned $400k into over $800,000.

I was on fire.

One of the popular trades at the time was shorting a new ETF that tracked volatility called VIX. Because of the decay of the underlying asset, this ETF continually lost value as long as the market was up or even moving sideways.

The more I won, the more I wagered.

And to make bigger and bigger bets, I started using margin.

I found a new strategy called a synthetic short, where I could use leverage to control significantly more options contracts, and reap even bigger gains.

I was making money hand over fist.

That is, until I wasn’t.

You see, I no longer had the luxury of mimicking the trading desk at my old firm.

I was on my own.

And I was in over my head. I had taken on leverage and placed a trade that I didn’t truly understand.

I woke up one morning to check my account, expecting to see fresh gains (like I had on all the mornings leading up to this one).

I opened my account, and it was as if the air was sucked right out of my lungs.

There was a market selloff.

Volatility had spiked.

My short had unlimited exposure.

My position was liquidated in a margin call. I stared at the screen, trying to make sense of what had happened.

I had lost $400,000 in the blink of an eye.

I closed my laptop and didn’t open it for months.

I was lucky. I only lost house money, the profits I had made over the last six months of diligent trading.

But the loss still stung like nothing I had ever experienced.

The tide had gone out, and I was naked.

Here’s another Buffett quote to ponder:

“If you’re smart, you don’t need leverage; if you’re dumb, you shouldn’t use it.”

It’s clear I was in the latter camp back then.

But leverage isn’t limited to stock trading.

When the economy is booming, leverage is available everywhere.

Maybe it’s a line of credit to buy inventory or an unlimited Amex that allows you to spend ad dollars without paying back for 60 days.

Maybe it’s hard money loans that allow you to buy rental properties.

But ask yourself: how would you act if you knew an economic downturn was inevitable?

Because that’s the truth.

It may not be this week or this year, but the good times won’t last forever.

Of course, maybe it’s different this time.

That’s one bet I’m not willing to take.

Swiping left on leverage,

Mb