I’ve had several conversations this week that remind me just how distorted our collective views on investing tend to be.

In these conversations, I’ve talked to founders who:

- After selling their company, made six angel investments, 5 of which failed in the first year

- Lost six figures in a single night in a Forex trading account

- Wiped out $8,000,000(!) of profits trading 100x leveraged bitcoin

- Invested over $30M in complicated financial instruments that resulted in more fees to the broker than returns to the investor

These conversations occurred only last week. Over the past few years, I’ve talked to hundreds of founders who have shared stories of massive losses.

We have been trained to normalize these types of losses as part of the game.

To win big, you have to bet big, or so we are led to believe.

I used to believe this idea, too. I lost millions in risky bets before I saw the light.

It was these losses that inspired me to create my Rules of Wealth, none more important than Rule #1:

Never Lose Money.

I learned this rule from one of the largest family offices in the U.S. after asking them to invest in my new venture capital fund. You can read that full story here.

Why is this rule so counterintuitive to what we believe?

It seems simple enough.

Yet, I am almost always met with deep, sometimes hostile resistance whenever I share this fundamental rule.

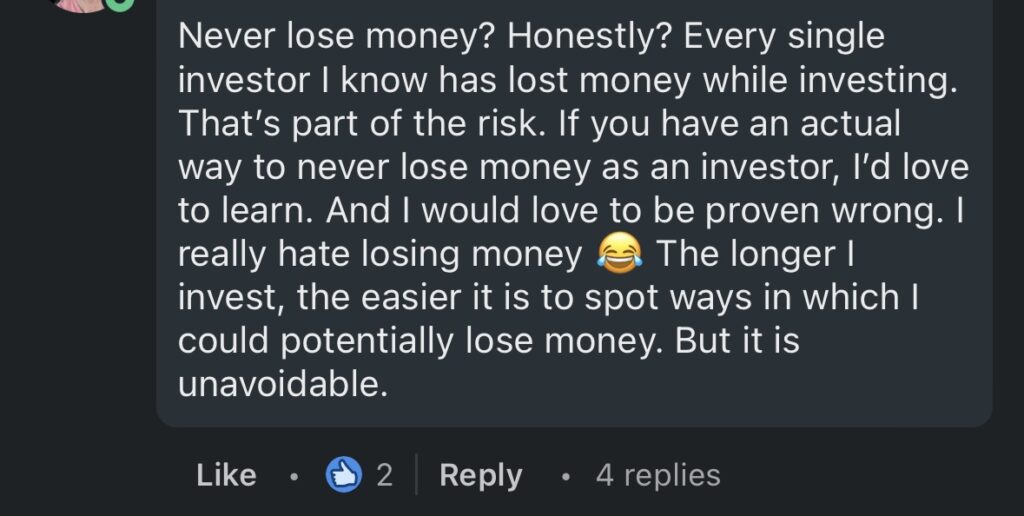

This comment on my recent LinkedIn post outlining my Rules of Wealth captures this attitude succinctly:

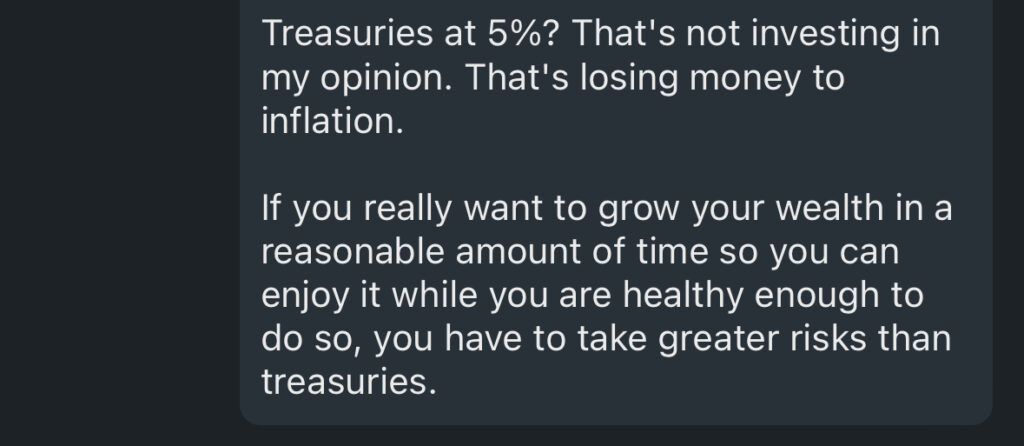

In response to this comment, I suggested the simplest example: US Treasuries, which currently yield 5% with near-zero risk.

This answer spurred another incredulous founder to jump in:

So, back to my question: Why do we normalize losses as a necessary part of investing?

I believe it’s because it allows us to keep the get-rich-quick dream alive.

Deep down, we all want to believe that we are one magic trade away from a life of riches.

This is the same reason that approximately half of American adults (150 million for those of you keeping score) play the lottery every year.

Let’s face it: we all want something for nothing. It’s human nature.

But the problem is the cost of losses is far more than nothing.

A mentor once told me the key to building wealth is “Don’t make it twice.”

Every dollar we earn through work has a cost associated with it. We traded time, our only non-renewable resource, in exchange for that dollar—time that we can never get back.

Every time we lose that dollar, we essentially have given our precious life force away for free.

This is how we end up stuck on the proverbial treadmill of trying to get ahead.

Now, I’m not suggesting that we should stash our hard-earned dollars under the mattress or bury them in the backyard.

The key is letting go of the idea that we must take outsized risks and beat the market.

This is one of the most profound lessons that I have learned over a decade as a professional investor.

The truth is, we don’t need to beat the market.

The historical average return of the S&P 500 is 8%. That means that $1 invested now is worth $10 in 30 years.

To put that in context, losing $50,000 now is the equivalent of giving up $500,000 that our future selves could have enjoyed.

Further, widespread research shows that more than 90% of retail investors fail to beat the market average over the long term. Professional investors fare no better. Studies have shown that only about 5-10% of mutual fund managers outperform their benchmarks over long periods, even when adjusting for survivorship bias (the tendency for unsuccessful funds to be closed and thus not included in the analysis).

I define financial freedom as when our assets generate enough cash flow to cover our ideal spending level without drawing down on the principle. I call this tipping point reaching Escape Velocity.

As founders, our goal should be simple: reach escape velocity as quickly as possible.

Through this lens, our financial decisions become infinitely simplified.

Our primary business is our escape vehicle, our unfair advantage. We can directly control the outcome. Once we have reached product-market fit and can generate reliable profits, all of our focus should be on growing our business and shortening our timeline to freedom.

In our quest to reach escape velocity, losses have no place. They only cost us more time.

This is how we can systematize our wealth creation. Given enough time, financial freedom becomes inevitable by focusing on growing our business, reinvesting profits, and eliminating losses.

We can reframe our view of risky investments from potential golden tickets to sinkholes on the road to wealth, to be avoided at all costs. We trade home runs and strikeouts for stacking singles.

But this system doesn’t come without its own cost.

It requires us to give up the get-rich-quick dream.

That’s one trade I’m willing to make.

Just say no to losses,

Mb