The world is full of advice, especially when it comes to finances. Countless books, podcasts, blogs, magazines, and even 24-hour news networks are dedicated to helping us make better financial decisions.

Titans of finance, economists, and pundits pontificate endlessly on how we should be investing our money, and promise us that if we just follow their advice, then we will finally be financially free.

There is more information at our fingertips than one could possibly consume in a thousand lifetimes.

So, why then, are there not a whole lot more rich people? With all of this advice at our disposal, why don’t we follow it?

The first answer is that all of this advice is overwhelming. Conflicting strategies, complicated structures, and thousands of pages of incomprehensible tax code keep us second-guessing and leave us wondering if we will ever find the right answers.

Information overwhelm is the number one reason people cite for not taking action on their finances. And it’s no wonder that this is the case as the goal of the financial industry is to keep us stuck in overwhelm, causing us to hand over our money to be managed by experts who promise us that if we just allow them to manage our wealth, they’ll keep us safe from the pitfalls looming around every corner.

Fear is the currency of finance.

But if we look one level deeper, there is another, more insidious reason we don’t follow the advice available to us.

Even if we have an idea of what we should be doing, there is a powerful force working against us. This unseen foe foils the best-laid plans, rearing it’s ugly head at every turn, keeping us on the endless treadmill.

This enemy resides in all of us, and unless we address it at its roots, we have little hope of achieving the freedom we seek.

This dastardly villain is our subconscious.

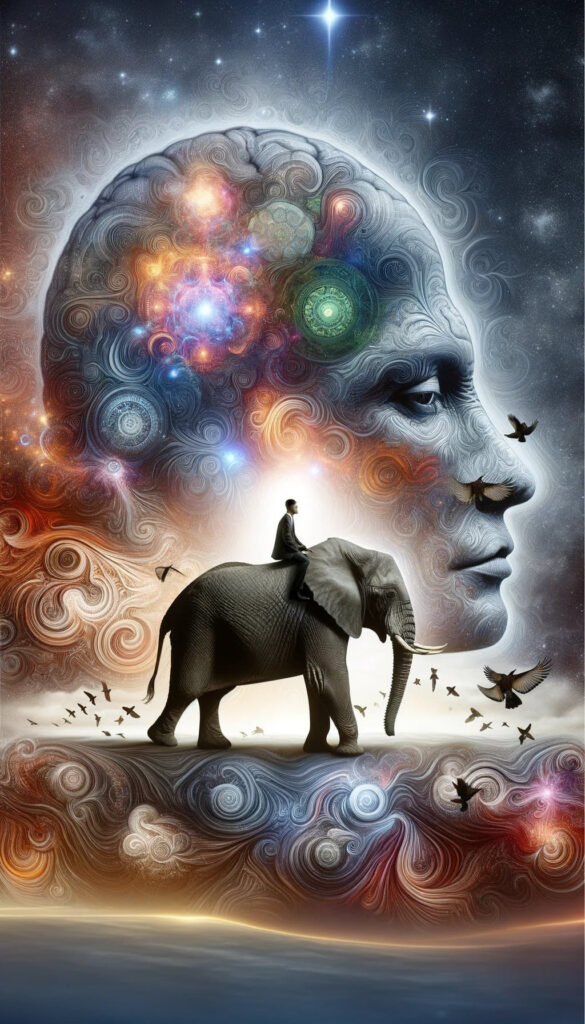

In the Happiness Hypothesis, Jonathan Haidt gives us the useful analogy of the elephant and the rider. Our rational brain (represented by the rider) believes it is in charge, guiding the elephant (our subconscious) with logic, problem-solving ability and knowledge. But at the first sign of danger (real or perceived) the elephant takes over, its immense power little affected by the desires of the rider.

Further, most entrepreneurs possess traits associated with a driven personality type. Detailed by my good friend Dr. Doug Brackman in his seminal book Driven, we learn that brains of high performers often possess either the DRD2 or DRD4 genes, as well as high levels of neuropeptide Y.

What this means in layman’s terms is that in stressful situations, of the type that trigger a fight or flight response in most people, driven personalities anchor into a state of hyper focus. Those of us lucky enough to possess this genetic gift actually find calm in the chaos – and this allows us to elicit a state of high performance, driving us to succeed where others fail.

As one might guess, this is a very useful genetic adaptation – except when we are actually safe.

The shadow side of the driven is that when things are actually calm, when there is no threat to vanquish – we will manufacture chaos.

Business going well? This is when we launch a new product, acquire a competitor, or decide we need to fire our marketing team and start from scratch.

We do this in our personal lives as well. When we reach a place of stability, this is exactly when we decide to remodel our house, adopt a puppy, or… gasp, have a new baby.

Because we are wired to perform under pressure, calm is our kryptonite.

This is the science of self-sabotage.

Our financial lives, of course, are no exception. As we start to reach financial stability, when we finally have income beyond our expenses, rather than settling into the relative peace we have created for ourselves, we go about making things complicated.

As a result, all of the good advice in the world is worthless to us.

Unless we dig into our core beliefs about money, unless we find and eliminate the subconscious patterns that run in the background, we are doomed to repeat the past.

Despite a decade of generating millions in returns as a professional investor, this is why I continued to make questionable decisions with my finances.

Because even though I knew the right answers, my elephant was happily going about creating chaos.

It wasn’t until I dove into therapy, hired coaches and chose the hard work of rewiring my subconscious that I was able to finally implement a plan to rebalance for true wealth. I was finally able to create systems and build rules that would keep me on track, even when my subconscious sought to sabotage my progress.

I created a playbook for myself, designed to use my money to create the freedom that I so deeply desired, and that playbook became the basis for the Unbreakable Wealth curriculum.

I first shared it with 16 amazing humans during my first retreat, held at my home in the foothills of Colorado, a year and a half ago. Since then I’ve hosted retreats and run workshops all over the globe, and I’ve continued to build and refine that playbook, using what I learned as we dove deep into hundreds of entrepreneurs’ self-sabotaging beliefs.

And now, for the first time, I’m taking this powerful program online.

I’m doing it with one goal – to get it into the hands of more people. If I eliminate the need for people to travel to an in-person event, the simple fact is that we can create better outcomes for more people, more quickly.

Unbreakable Wealth invites you into the vulnerable exploration of examining your relationship with money and how you can leverage that understanding to become a greater steward of your wealth.

We break down expired notions around what money is and can be – reframing it from a tool that holds us captive to a powerful catalyst in building an intentional life of freedom. Armed with new awareness, we then craft a playbook of balanced, risk-adjusted actions to bridge the gap between wealth and fulfillment.

If this mission resonates with you, our all-new, immersive program begins November 15th.

To get started, simply apply here. Our short screening process ensures that you are a fit for the program and that we can best serve your desired outcomes. Once we’ve determined mutual fit, it’s off to the races – doing the work of becoming the master of your financial journey.

Whether you just crossed $1MM in revenue for the first time or you are managing a 9-figure investment portfolio, this program is designed to help you make better decisions with your wealth.

We’ve already started to gather an incredible community of world-class entrepreneurs, athletes, doctors, and other high-earners.

If you are called to join us, hit apply now and I’ll see you on the other side.